Ontario real estate professionals can now incorporate, thanks to the passing of Bill 145 this past March and legislation passing on October 1, 2020. First—and likely most important—is to understand the tax benefits of incorporation.

Of course, once you withdraw funds from a PREC, that money is subject to your personal tax rate. Fortunately, with a bit of planning, it is possible to minimize the amount of taxes you owe when doing so. Here are a few ways how:

1. TAX DEFERRAL

Primary among these benefits is the ability to defer taxes by earning income inside a PREC, which is taxed at a lower rate than personal income. To understand these tax deferral opportunities, consider the following example:

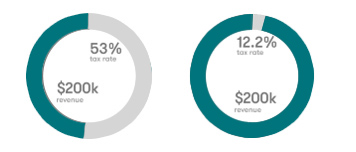

For a real estate agent in Ontario, the marginal tax rate on earnings in excess of $220,000 is approximately 53.50 percent.

Earning income through a PREC, however, would allow the corporation to pay tax on the income earned inside the corporation —at a 2020 rate as low as 12.20 percent. This assumes that the income in the PREC is subject to the small business rate that applies on the first $500,000 of active business income. This would allow excess income to be invested inside the company, with personal taxes only applying when you draw out funds as either a salary or dividend.

This assumes that the income in the PREC is subject to the small business rate that applies on the first $500,000 of active business income. This would allow excess income to be invested inside the company, with personal taxes only applying when you draw out funds as either a salary or dividend

This assumes that the income in the PREC is subject to the small business rate that applies on the first $500,000 of active business income. This would allow excess income to be invested inside the company, with personal taxes only applying when you draw out funds as either a salary or dividend.

2. SPLITTING INCOME

Perhaps one of the greatest benefits of setting up a PREC is the opportunity to income split. While the federal government introduced strict rules around Tax on Split Income (TOSI) in 2018, you can still use a PREC to split income with lower-earning family members—but there are a few caveats.

As it stands, you have two income-splitting options when it comes to PRECs: you can pay your family members wages or issue them dividends. The catch is that, when paying wages, the wages must be for “reasonable services performed”, which means your family members must be actively engaged in the business.

If you try to get around that rule by issuing dividends to your family members, you’ll likely be taxed at the highest marginal tax rate (thanks to TOSI). However, there are a few exceptions. If your family member is actively engaged in the business (and is averaging at least 20 hours a week)—or is receiving a reasonable return based on their work performed, property contributed, or risks assumed relative to the corporation— their dividend income can be excluded from TOSI. The same is true if you, the real estate professional, are over the age of 65 (allowing you to income split in retirement).

3. DECLARE DIVIDENDS RATHER THAN PAYING A SALARY

Real estate professionals who are self-employed are required to remit both the employee and employer portion of their Canada Pension Plan (CPP) contributions. For 2020, that combined amount is approximately $5,800.

With a PREC, however, you have the opportunity to pay yourself either a salary or dividends. If you pay yourself a salary, you’ll still need to remit CPP. But if you pay yourself a dividend, CPP contributions aren’t required, leaving you with excess cash to invest in other income-producing investments. That said, you should be mindful of the impact of paying yourself a dividend and the availability of claiming personal child care expenses and making RRSP contributions. We can help you navigate through the complexities.

3. WAIT UNTIL A LOW-INCOME YEAR

Canada’s marginal income tax regime means that, the more money you earn in a year, the higher your tax rate will be. On the flip side, lower-earning years could reduce your tax rate—which explains why it may make sense to withdraw funds during a slow year—for instance, upon retirement or in a year where you’re taking parental leave.

A complex process

A PREC can be an excellent tool for real estate professionals looking to maximize their hard-earned commissions. That said, to make it work, you need a plan. If you require support in navigating this new world of incorporation, contact Tax Partners at info@taxpartners.ca or by phone at (905) 836-8755 for a free initial consultation and we will be happy to help.