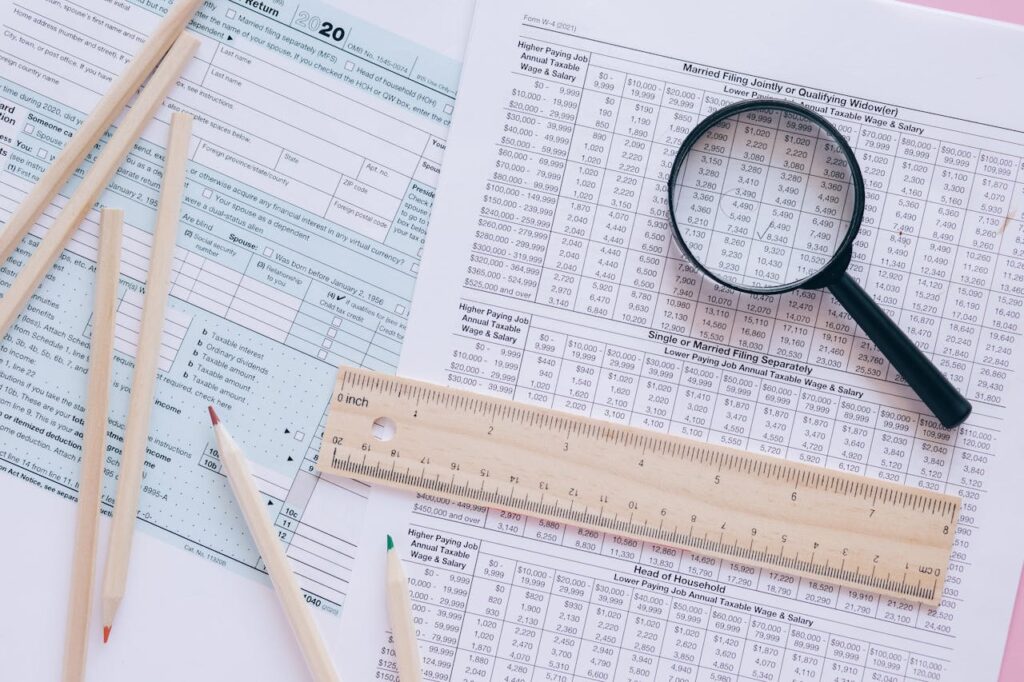

Introduction Tax season is an important time for medical professionals in Canada, but with demanding...

Category Archives: Blog

Introduction Medical professionals in Canada manage complex financial responsibilities alongside the...

Introduction Medical professionals in Canada dedicate their careers to patient care, often leaving f...

Introduction When operating as an incorporated medical professional in Canada, one of the most criti...

Introduction For many Canadian medical professionals, purchasing a first home is a major financial m...

Introduction Economic conditions in Canada are shifting rapidly, with inflation and fluctuating inte...

Introduction For Canadian medical professionals, tax planning is not just a once-a-year event—itâ€...

Introduction Navigating the financial landscape can be complex, particularly for Canadian medical pr...

Introduction Incorporated professionals in Canada, including physicians and business owners, can lev...

Introduction Paying off a mortgage faster is a goal for many physicians in Canada. As an incorporate...